SEC Guidelines 2025: Crypto Journalism’s New Reality

The latest SEC guidelines issued in January 2025 profoundly impact US crypto journalism platforms, necessitating immediate adjustments in content creation, disclosure practices, and financial reporting to ensure compliance and maintain audience trust.

The digital asset space is constantly evolving, and with it, the regulatory landscape. For US publishers operating in this dynamic environment, understanding SEC crypto journalism guidelines issued in January 2025 is not just advisable, it’s absolutely critical. These new directives are poised to redefine how news and analysis are presented, impacting everything from editorial independence to advertising practices.

Understanding the new SEC framework for digital assets

The Securities and Exchange Commission (SEC) has consistently sought to bring clarity and oversight to the rapidly expanding digital asset market. The January 2025 guidelines represent a significant step in this ongoing effort, moving beyond previous advisories to establish a more concrete framework. These regulations are designed to protect investors, ensure market integrity, and combat illicit activities within the crypto ecosystem, directly influencing how news about these assets is disseminated.

For crypto journalism platforms, this means a shift from a largely self-regulated environment to one with explicit expectations regarding disclosure, factual accuracy, and potential conflicts of interest. The SEC’s focus extends to any entity that publishes information that could influence investment decisions related to digital assets, positioning news outlets squarely within its purview. Publishers must now meticulously review their operational procedures and content strategies to align with these new legal realities.

Defining ‘Digital Asset Securities’ and their implications

A core element of the new guidelines is the SEC’s refined definition of what constitutes a ‘digital asset security.’ This classification is crucial because it determines which assets fall under the SEC’s regulatory authority. Publications that discuss these assets must understand this distinction to accurately report on them without inadvertently violating securities laws.

- The Howey Test: The SEC continues to primarily rely on the established Howey Test to determine if a digital asset is an investment contract and thus a security.

- Evolving Interpretations: The January 2025 guidelines provide updated examples and scenarios, reflecting the maturation of the crypto market and the emergence of new asset classes.

- Impact on Reporting: Journalists must now exercise greater caution when characterizing digital assets, avoiding language that could be misconstrued as investment advice for unregistered securities.

The implications of this redefinition are far-reaching. News platforms that frequently cover initial coin offerings (ICOs), security token offerings (STOs), or even certain decentralized finance (DeFi) protocols will face increased scrutiny. Understanding the nuances of these classifications is paramount to maintaining journalistic integrity while navigating regulatory compliance.

Enhanced disclosure requirements for publishers

One of the most immediate and impactful changes for crypto journalism platforms under the new SEC guidelines is the implementation of enhanced disclosure requirements. These rules aim to ensure transparency and mitigate potential conflicts of interest that could mislead readers or influence market behavior. Publishers are now expected to be more explicit about their financial relationships, if any, with the projects or assets they cover.

This goes beyond simple disclaimers; the SEC is pushing for a systemic approach to transparency. News organizations must develop robust internal policies to track and disclose any holdings of digital assets by staff members, financial ties to crypto companies, or compensation received for promoting specific tokens or projects. The goal is to provide readers with a clear understanding of any potential biases that might inform the content they consume.

Affiliate marketing and sponsored content under scrutiny

The guidelines pay particular attention to affiliate marketing and sponsored content arrangements, which are common revenue streams for many online publications. The SEC is concerned that such arrangements, if not properly disclosed, can blur the lines between objective reporting and promotional material, potentially misleading investors.

- Clear Labeling: All sponsored content and paid promotions must be clearly and conspicuously labeled as such, distinguishing them from independent editorial content.

- Disclosure of Compensation: The nature and extent of compensation received for promoting digital assets must be disclosed, including whether payment was made in tokens, fiat currency, or other forms.

- Affiliate Link Transparency: Publishers using affiliate links for crypto-related products or services must also provide clear disclosures about their financial interest in those links.

These requirements demand a comprehensive review of existing monetization strategies. Platforms may need to revise their content creation workflows and implement new editorial policies to ensure full compliance. The consequences of non-compliance, including fines and reputational damage, are significant.

Navigating anti-fraud and anti-manipulation provisions

The SEC’s January 2025 guidelines significantly bolster anti-fraud and anti-manipulation provisions, extending their reach to encompass digital asset markets and the information disseminated about them. For crypto journalism platforms, this means an increased responsibility to ensure the accuracy and integrity of their reporting. Publishing false or misleading information, even inadvertently, could now carry severe legal repercussions.

Journalists and editors must adopt a heightened level of due diligence in fact-checking and verifying sources related to digital assets. This includes scrutinizing claims made by project founders, evaluating technical specifications, and cross-referencing market data. The SEC’s intent is to create a more trustworthy information environment, thereby reducing opportunities for market manipulation and investor exploitation.

The role of objective reporting in a volatile market

In a market as volatile and prone to speculation as digital assets, objective and accurate reporting is paramount. The new guidelines underscore the importance of avoiding sensationalism, unsubstantiated claims, and biased analysis that could unduly influence market sentiment. This places a significant burden on publishers to uphold the highest journalistic standards.

- Fact-Checking Protocols: Implement rigorous fact-checking procedures for all crypto-related content, especially price predictions or performance claims.

- Source Verification: Prioritize credible, verifiable sources and clearly attribute all information to prevent the spread of misinformation.

- Avoiding Pump-and-Dump Schemes: Be acutely aware of how reporting can be exploited by bad actors for pump-and-dump schemes and take steps to prevent participation.

Maintaining editorial independence while navigating these provisions requires a delicate balance. Publishers should invest in training their editorial teams on the intricacies of digital asset markets and the legal implications of their reporting. This proactive approach can help mitigate risks and build greater trust with their audience.

Implications for content creation and editorial independence

The new SEC guidelines inevitably prompt a re-evaluation of content creation processes within crypto journalism platforms. While the goal is not to stifle free speech or honest reporting, the emphasis on compliance and investor protection will undoubtedly influence editorial decisions. Publishers must find a way to balance informative, engaging content with the strictures of regulatory oversight.

Editorial independence, a cornerstone of journalism, could feel challenged by these new rules. However, rather than viewing them as restrictive, platforms can leverage them to enhance their credibility. By demonstrating a strong commitment to ethical reporting and transparency, crypto journalism can distinguish itself as a reliable source of information in a sometimes-turbulent sector.

Developing robust internal compliance policies

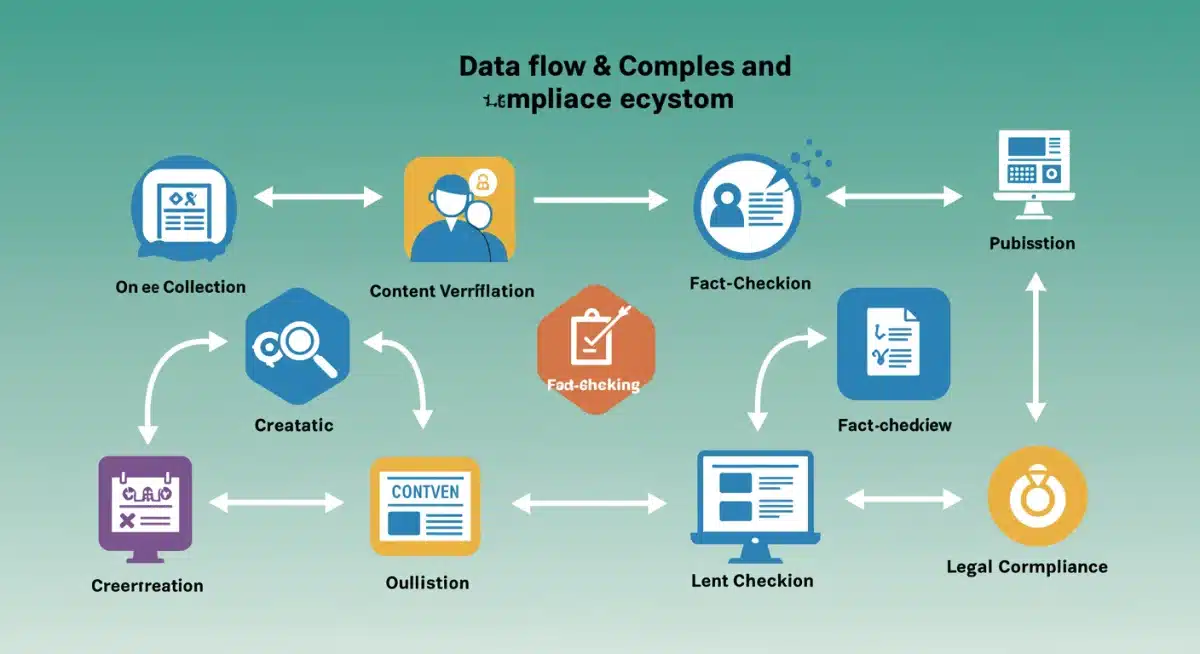

To effectively navigate the new regulatory landscape, crypto journalism platforms must develop and implement robust internal compliance policies. These policies should be comprehensive, covering everything from content review and disclosure protocols to employee trading guidelines for digital assets.

- Editorial Review Boards: Establish an internal review process for all crypto-related content, possibly involving legal counsel or compliance officers.

- Employee Trading Restrictions: Implement clear rules regarding employees’ ability to trade digital assets, especially those covered by the publication, to prevent insider trading or conflicts of interest.

- Training and Education: Provide ongoing training for all staff on SEC guidelines, digital asset classifications, and ethical reporting standards.

These internal measures are not just about avoiding penalties; they are about building a reputation for trustworthiness. In an industry often plagued by scams and misleading information, platforms that prioritize compliance and ethical journalism will stand out, attracting and retaining a loyal readership.

The role of technology in compliance and transparency

As the SEC’s guidelines become more stringent, technology will play an increasingly vital role in helping crypto journalism platforms achieve and maintain compliance. Automation, artificial intelligence, and blockchain-based solutions can offer innovative ways to manage disclosures, track content origins, and ensure transparency across all published materials. This technological integration is not merely an option but a strategic necessity for future-proof operations.

From automated disclosure prompts within content management systems to AI-powered tools that scan for potential conflicts of interest, technology can streamline compliance efforts. Furthermore, leveraging blockchain’s inherent transparency features could allow platforms to verifiably timestamp content, prove editorial independence, or even manage tokenized compensation models with greater clarity, fostering an environment of verifiable trust.

Leveraging AI for content review and risk assessment

Artificial intelligence (AI) can be a powerful ally in navigating the complexities of the new SEC guidelines. AI tools can rapidly analyze vast amounts of content, identifying phrases or claims that might trigger regulatory scrutiny or require explicit disclosure. This proactive risk assessment can save significant time and resources, allowing editorial teams to focus on quality journalism.

- Automated Disclosure Prompts: AI can integrate with CMS platforms to suggest or require disclosures for specific keywords or asset mentions.

- Sentiment Analysis: Tools can analyze content for biased language or unsubstantiated claims that might fall under anti-manipulation provisions.

- Compliance Audits: AI can perform continuous audits of published content against predefined regulatory criteria, flagging potential issues before they escalate.

By embracing these technological advancements, publishers can not only meet the SEC’s demands but also enhance the overall quality and reliability of their crypto-related content. This positions them as leaders in a new era of responsible crypto journalism.

Future outlook: adapting to an evolving regulatory landscape

The January 2025 SEC guidelines are not an endpoint but rather a significant milestone in the ongoing evolution of digital asset regulation. Crypto journalism platforms must recognize that the regulatory landscape will continue to shift, requiring constant vigilance and adaptability. Staying ahead means fostering a culture of continuous learning and proactive engagement with legal and compliance experts.

The long-term success of US crypto journalism will depend on its ability to evolve alongside these regulatory changes, demonstrating a commitment to informing the public responsibly and ethically. This adaptability will build resilience and ensure that these platforms remain trusted sources of information in a complex and critical sector.

Collaboration and industry best practices

In this dynamic environment, collaboration among crypto journalism platforms and industry stakeholders will be crucial. Sharing best practices, insights, and compliance strategies can help elevate the entire sector, ensuring that collective efforts contribute to a more transparent and trustworthy information ecosystem.

- Industry Working Groups: Participate in or form groups dedicated to understanding and interpreting new regulations for media entities.

- Legal Counsel Engagement: Regularly consult with legal experts specializing in securities law and digital assets to stay informed of changes and interpretations.

- Audience Education: Play an active role in educating readers about the evolving regulatory landscape and the importance of due diligence in crypto investments.

By embracing these forward-looking strategies, crypto journalism platforms can not only navigate the current SEC guidelines but also prepare for future regulatory developments. This proactive approach will solidify their position as essential, credible voices in the digital asset space.

| Key Impact Area | Brief Description |

|---|---|

| Digital Asset Classification | Refined definitions impact how crypto assets are reported, especially regarding securities status. |

| Disclosure Requirements | Mandatory transparency for financial ties, sponsored content, and staff holdings. |

| Anti-Fraud Provisions | Heightened responsibility for accurate, objective reporting to prevent market manipulation. |

| Compliance Technology | Leveraging AI and blockchain for efficient content review and enhanced transparency. |

Frequently Asked Questions About SEC Crypto Journalism Guidelines

The main changes include clearer definitions for digital asset securities, enhanced disclosure requirements for financial relationships and sponsored content, and stricter anti-fraud provisions. These aim to increase transparency and investor protection in crypto reporting.

While not intended to stifle free speech, the guidelines necessitate a re-evaluation of content creation processes to ensure compliance. Publishers must balance informative content with strict regulatory oversight, potentially influencing editorial decisions to prioritize transparency and accuracy.

Sponsored content and promotions must be clearly and conspicuously labeled, distinguishing them from editorial content. Publishers must also disclose the nature and extent of compensation received, including whether it was in tokens or fiat currency.

Yes, but with strict internal policies. Platforms must implement clear rules regarding employees’ ability to trade digital assets, especially those covered by the publication, to prevent conflicts of interest and ensure proper disclosure.

Technology, including AI and automation, can be crucial for compliance. It can help with automated disclosure prompts, sentiment analysis for content review, and continuous audits against regulatory criteria, streamlining efforts and enhancing transparency.

Conclusion

The January 2025 SEC guidelines mark a pivotal moment for US crypto journalism platforms. These regulations underscore the growing maturity of the digital asset market and the imperative for heightened responsibility in reporting. By proactively adapting to these changes, embracing enhanced transparency, and leveraging technological solutions, publishers can not only ensure compliance but also fortify their credibility. This proactive approach will be essential for maintaining trust and relevance in an increasingly regulated and complex crypto landscape, ultimately benefiting both the industry and the informed investor.